What is a Credit Score?

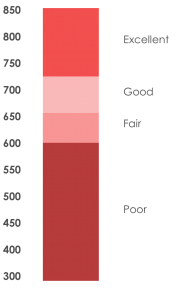

Your credit score is a number between 300 and 850, assigned to you by a credit bureau, that helps lenders decide how creditworthy you are — the higher the score, the lower the risk. Because credit can affect many important aspects of your life, getting and keeping your score as high as possible is vitally important.

With a free credit score analysis our loan officers can assist you with managing your credit score.

Contact a loan officer today!

What is a good score?

There is no absolute standard that lenders use to approve or deny credit. The chart is merely a guide. Remember, a good score is one that works with, not against, your life goals. Staying informed and making smart financial choices is your best strategy for keeping your score on a steady climb.

Credit scores are based on your financial behavior and history, and do not include factors such as gender, race, religion, national origin, education level or marital status.

It’s your credit. Don’t neglect it.

While your credit score gauges your creditworthiness with a number, your credit report tells the full story of your financial activities.You are entitled to a free copy annually from any of the three main credit bureaus.

Go to: www.annualcreditreport.com to request your free credit report.

Equifax Experian

www.equifax.com www.experian.com

Credit Reports: 1-800-685-1111 Credit Reports: 1-888-397-3742

Fraud Hotline: 1-888-766-0008 Fraud Hotline: 1-888-397-3742

Trans Union

Credit Reports: 1-877-322-8228

Fraud Hotline: 1-800-916-8800